First, I left out an important short-term silver chart yesterday - an updated version of my chart from last week suggesting good entry points into the silver market after the strong move two weeks ago. My omission turned out fortuitous, because the dotted green trend line I was watching was hit again today, making tomorrow's action worth following closely. Will silver bounce up, or close below it -- perhaps all the way down to the solid green line (which would be an even better entry point, IMO). I'm short term bullish so long as that solid line isn't broken, the overbought status on most momentum indicators notwithstanding.

Moving on, I'd like to open a discussion concerning manipulation. I find myself far closer to the "tinfoil hat" side of the debate than most of the contributors here, including most of our distinguished commenters, who are all strongly skeptical of any pervasive interference in the metals markets (as alleged by GATA, Turd Ferguson, Ranting Andy Hoffman, SGS, etc.)

I defend my position using three simple axioms, from which, as I see it, the necessity for manipulative mechanisms (if not the actual constant perpetration thereof) follows rather plainly: (1) The demand for gold and silver increases as the price goes up; (2) "a runaway gold price would certainly be the end of the current fiat money system in very short order" (Ed Steer); and (3) every ruling class (indeed every organic entity) will fight relentlessly for its self-preservation.

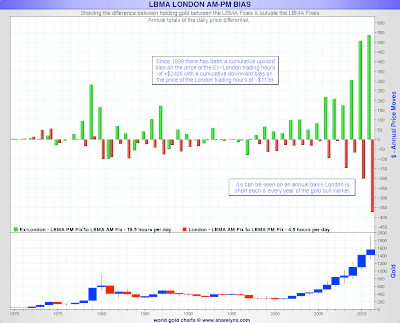

So I'd be interested in how those I will rather uncharitably call "manipulation deniers" would explain the following popular chart from Ed Steer, of Casey Research and GATA, which I regard as pretty strong empirical evidence of the axiom-based manipulation hypothesis:

Steer explains this chart, made for him by Nick Laird, as follows:

The red line is the price rise or fall that occurs between the London AM fix and the London PM fix ... Except for a handful of years, it's been showing a negative price bias just about every year for the last 42 years. It's particularly noticeable during the current bull market.So what the overnight markets giveth, the London and New York markets, working together, make every attempt to taketh away. This is where the name of the chart comes from "LBMA London AM-PM Bias."[In] January [data not shown on above chart]… the overnight bias showed an increase of $169...or 10.4%. The London intraday bias was -0.02%. So here we have one of the biggest bull market rallies in January in recorded history, and the cumulative move during the 4.5 hour intra-London trading hours during January was actually negative. This is Anglo/American price fixing scheme laid bare [emphasis mine].

21 comments:

The big assumption behind the call to interpret this skew as proof of manipulation is that buying and selling should be evenly distributed during a day, or more to the point, that if there is net buying during a period, then it should happen evenly during the period. I’m not sure this assumption is necessarily correct. I would suggest the following factors which may legitimately account for a skewing:

1. Aggregation of Indian & Asian net buying on the AM fix

London fixes are compressing or aggregating trading. If they did not exist then we can speculate that the trades that happen on the fix would just occur throughout the day. With the fixes, clients and their brokers “build up” orders during the periods preceding the fixes. So which markets precede the AM fix? Hmm, India and Asia. They are over time net buyers. So logically the AM fix would get predominant aggregation of buying, hence we could expect the AM to be big higher than normal, or more to the point, higher than the PM.

2. Preference for retail investors to trade long side and do so at the beginning of the day

Studies have shown that traders tend to prefer going long, rather than shorting (which is apart from futures, difficult for only the professionals to do in gold). Traders start the day reading the news and then forming a view as to whether gold will go up or down during the day. So we could argue then tend to buy in the morning (ie AM fix) and then sell up before the day closes (ie the PM fix) as few would want to run a position overnight where you don’t have as much control.

3. AM to PM time period is only 4.5 hours

We are not comparing like time periods. Shorter time period/sample size means more likely to show anomalies. If we were able to pick a different time period, eg London Open to NY Close, would it show the same skew. This needs to be investigate. The focus on the London Fixes is only because that is readily available data.

I am not saying that the above explain away the skew but I think there needs to be some acknowledgement that there may be some other factors accounting for part of the skew.

London - "Please Explain"

After a huge up-month in January how do you reconcile this bias?

http://www.sharelynx.com/chartstemp/LBMA.gif

Please note that I have done the same calculations for Platinum & Palladium using the LPPM daily fixes.

Data from here:

http://www.lppm.org.uk/

For Palladium since April 1990

Cumulative Overnight changes = 1166.6

Cumulative Intraday changes = -583.25

For Platinum since April 1990

Cumulative Overnight changes = 3980.85

Cumulative Intraday changes = -2821.35

Wow - please explain these....

I've also done the same for New York trading using the CME Futures dataset for gold with the open & close of the days being the regular fix.

The NY Gold Bias is good for gold but the NY Silver Bias is bad for silver.

For NY Gold since 1970

Cumulative Overnight changes = 1086.8

Cumulative Intraday changes = 476

For NY Silver since 1970

Cumulative Overnight changes = 40.09

Cumulative Intraday changes = -7.88

If I could post the charts with html code I would but the blog doesn't allow.

Lots more analysis into these Bias charts needed!

@Bron,

What you said are all very true (and thanks again for your industry knowledge) but I believe those factors exist before 1999 as well. And if you look at Nick's chart, it is very clear, at least to me, that the pattern changed after 1999, which is very different than the last bull of 70s and the 20 years in between, during which, all the factors you mentioned existed as well. So no, I don't think one can use your 3 factors to explain this post-1999 bias at all, of at least, bias to such an extent.

Whereas, I think victor's theory over FOFOA has gained some further support from this chart, that prices of gold and silver (his point is gold only but mine's are both) are controlled.

You are being influenced by the fact that the chart shows aggregate dollar amounts. The picture would probably be clearer if the bars were percentages of the average price for that year.

Also consider that during most of the 90s the volatility of gold was very low compared to post 2000.

I think the charts shows a consistent negative posture in the red bars since 1975 whereas what is different pre-2000 is that the green is not always up.

But one also has to consider the market went through bull and bear phases. The claim of manipulation rests on the idea that during a bull phase (post 2000) both red and green bars should be generally positive.

On that reasoning, during bear 1996-2000 both red and green should be negative, yet 3 out of 5 green bars are positive. Conclusion - market was being manipulated upwards, particularly during 1998-2000?

The chart is certainly a pointer to something funny, but I feel a hard statistical analysis is need to bring some robustness - eg standard deviations, skewness, kurtosis, auto correlation within the data etc. Stuff beyond me. Without it we'll have a hard time convincing anyone on the outside.

@Bron,

"You are being influenced by the fact that the chart shows aggregate dollar amounts. The picture would probably be clearer if the bars were percentages of the average price for that year"

No, ignore the size of the bar, focus on the direction of the green and red bar for now.

"The claim of manipulation rests on the idea that during a bull phase (post 2000) both red and green bars should be generally positive"

No, it's nothing of that sort. In fact, it's quite the opposite! I am not looking for both green & red as UP for the 3 factors that you've explained very well above would definitely have some fundamental bias built-in for green and red bars. But it's the lack of variations of pattern in this bull:

(I am guessing from the chart with my naked eyes so it can be off a bit)

(A) 1970-1980, a bull market:

- green & red both up - 5 years

- green & red both down - 1 year

- green up & red down - 3 years

- green down & red up - 3 year

* longest consecutive pattern - 2 years

(B) 1981-1998, a bear market:

- green & red both up - 0 years

- green & red both down - 9 year

- green up & red down - 9 years

- green down & red up - 0 year

* longest consecutive pattern - 3 years

(C) 1999-2011, a bull market:

- green & red both up - 0 years

- green & red both down - 0 year

- green up & red down - 13 years

- green down & red up - 0 year

* longest consecutive pattern - 13 years

It appears to me, we at least had some variations in pattern in the last bull and bear (though green are generally up and red are generally down) but this lack of variation in patterns in the last 13 years, esp compare to last bull, should at least give someone food for thoughts.

@Bron,

And, I actually agree with yours:

"Conclusion - market was being manipulated upwards, particularly during 1998-2000?"

But changed:

Market was (is) being manipulated upwards in a controlled fashion.

indeed, this is prima facie evidence of manipulation, but the manipulation is HIGHER, not lower. It is the OVERNIGHT hours (in US time) that is being manipulated, as that timeframe is less liquid than the London AM-PM hours and thus easier to push around. The London and New York trading hours are much more liquid and thus much less manipulatable.

So I agree - something must be done about those evil manipulators scheming to push prices higher in the overnight sessions.

I have seen similar analysis done on the S&P 500, with similar results - and of course, the conclusion from the boys at Zero Hedge with an agenda was that the stock market was being manipulated HIGHER overnight... (as Brian just noted as a possibility with gold)

I guess it depends on which story you're trying to tell!

I didn't check any of Nick Laird's data, but he seems to claim that Palladium and Platinium also follow the pattern. As I noted, the SPX does too, so maybe it's not quite as crazy as you think! LOTS of assets exhibit this trend.

please tell me that no one is suggesting that a rise in the prices of plat/pall would lead to the rapid demise of fiat currency, so that they must be manipulated lower by the Powers That Be! (ps - GM - that's the one base claim of yourse that I'd strenuously object to. While the collapse of a fiat currency may likely result in rapidly accelerating gold prices, the contra is not true: rapidly accelerating gold prices do not result in the collapse of fiat currency).

I think Bron laid out some great points - Asian demand seems to be a big driver, and the lack of equal time periods for comparison is important too.

note that I believe that gold is a highly regulated (read: not free) market in China, right? Which can account for a lot of f*cked up price action that can't be effectively "fixed" by the market.

Hey, GM. I'm a believer!! Praise Woton.

You might be surprised, but I personally have no doubts about coordinated manipulation existing in the gold market. I just think it's manipulation of a very different type to that usually spun by the gold bugs.

The massive sell-off of gold in tandem with the CHF devaluation is a perfect case in point: it was a clear use of gold as a tool to aid an internationally coordinated currency devaluation. Manipulation writ large, in other words - and it's not even hidden.

This shouldn't be surprising. Currencies are overtly manipulated all the time. Look at the coordinated (and entirely avowed) intervention to suppress the Yen after last year's earthquake. And although gold standards no longer exist, gold still plays a role as a quasi-currency on the international stage.

Do GS and JPM and HSBC and all the other big boys engage in rather nefarious practices to maximise their profits? Such as introducing huge volatility to crash hedgies out of their stops (in both short and long positions)? Or badly advising clients to whom they're the counterparty? Or pushing hot money in and out of trades to create asset bubbles? I'm sure that they do all that and much more. I'm also sure that they couldn't care less whether the price goes up or down, and make masses of cash regardless. They just want the volatility, as that's how you make money.

But empty GLD and SLV vaults, and cartels price-capping 10-cent moves? And all the other demonstrably untrue nonsense? Forget it. For that, I'm proud to be a denier.

Central banks around the world routinely manipulate currencies and bonds, why wouldn't they manipulate gold too?

Good points so far on both sides. Special thanks for the incisive anti-manipulation points (Bron, Brian, KD), some that I should've thought of (e.g. sample sizes) and others i couldn't have. I don't have time to comment now, but my opinion doesn't matter that much anyhow, since I have no expertise in market mechanisms and look at this only from a common sense perspective.

I will disagree with KD's general point that "While the collapse of a fiat currency may likely result in rapidly accelerating gold prices, the contra is not true: rapidly accelerating gold prices do not result in the collapse of fiat currency." On the contrary, I think that because fiat replaced 5000 years of gold and silver as money, their value (and especially the rate of change of their value) measured in units of their replacement (fiat) has symbolic value, almost as if gold and silver perennially sit in judgement of the legitimacy of their usurpers who had the chutzpah to say "trust us to create value out of thin air: we will not abuse it. Go ahead and spend the better part of your life toiling for paper that we can create with the press of a button when it serves out interests."

@Nick Laird: thanks for your charts and analyses, and thanks for dropping by! I'm curious, what is your background - are you affiliated with Casey Research?

I just got an email from victor_the_cleaner, who directed me (as Warren also did) to an astute analysis by a commentator on FOFOA's blog, one "Michael H." Here is the cooment and the link:

*****************************************************One of the pieces of evidence put forth by people who believe that the gold and silver price is being suppressed is the presence of price ‘smackdowns’: sudden large sell orders executed in such a way as to run the price lower. The thinking is:

1. If you want to exit a large position, you sell it piecemeal so as to maximize the sale price.

2. Therefore, the large block sale orders are designed to run the price lower.

3. Thus, these orders are meant to suppress the price of gold and silver.

Items 1. and 2. above are correct, but item 3. does not necessarily follow. I have an alternate explanation to propose. This thinking is much the same as what costata put forth in his ‘Silver open forum’, but perhaps he can let me know if he thinks this is plagiarism, or if there is some original thought contained herein:

1. Who is entering these large block orders? Let’s assume it is the BBs, who have been described by costata and Bron as ‘spiders in the web of the PM markets’. They see the standing buy/sell orders, and they see the order flow as well.

2. What do these BBs want? They want to book some profits today. So they’ll try to use their position at the center of the web to make money (at your expense).

3. How will they make money? They will be able to tell which way the market is trending thanks to the order flow, and if they see standing orders about to be triggered, they’ll also be able to predict if the market swing will intensify. So:

[continued]

a. Market is trending in a certain direction.

b. BBs see lots of standing orders about to be triggered.

c. BBs place lots of orders, triggering the standing orders and combining with the market trend to form a large price swing. BBs exit their position at a profit before the swing reverses on them.

d. Easy money.

4. Which direction are these swings more likely to go: up, or down? Are there more standing sell stop orders, or buy stop orders? Are traders/investors/suckers more likely to want to exit positions to preserve a profit / avoid a loss, or to enter positions to jump on a price breakout? Which is more powerful, fear, or greed? I find it likely that the standing sell stops usually significantly outnumber the standing buy stops.

5. Are any of these sell stops “trailing” stops? I.e: sell Y amt of gold if the price drops X dollars from the previous high price. This could matter because, with the gold price trading at new relative highs, the trailing stops could tend to cluster just below the current price.

6. Add the ingredient that victor and I discussed: the gold price tends to be higher in Asian trading, and lower in NY trading. This is likely because of there are more buyers than sellers in Asia, and vice versa in the West. So we have a somewhat predictable daily price tendency: Asia is open so gold price rises, NY opens so gold price declines.

7. Now combine 4, 5, and 6. On a day when COMEX opens after the Asian market bid gold up to new relative highs, you will have:

a. More sell stops than buy stops in the order book, as usual.

b. Trailing stops clustered below the current new high price.

c. Trading flow tending to more sellers than buyers, thus lower prices.

Perfect ingredients for ‘smackdown stew’!

[continued]

Further, the best time for this ‘smackdown’ is as soon as the price starts to decline on its own accord, which might very well be the minute that the COMEX opens.

Or, maybe traders at different BBs get together and decide that at 8:25 or what have you they will all pile on, so that they get a nice big fat price move and they all get to pad their P&L for the quarter.

One of the pieces of evidence put forth by people who believe that the gold and silver price is being suppressed is the presence of price ‘smackdowns’: sudden large sell orders executed in such a way as to run the price lower. The thinking is:

1. If you want to exit a large position, you sell it piecemeal so as to maximize the sale price.

2. Therefore, the large block sale orders are designed to run the price lower.

3. Thus, these orders are meant to suppress the price of gold and silver.

Items 1. and 2. above are correct, but item 3. does not necessarily follow. I have an alternate explanation to propose. This thinking is much the same as what costata put forth in his ‘Silver open forum’, but perhaps he can let me know if he thinks this is plagiarism, or if there is some original thought contained herein:

1. Who is entering these large block orders? Let’s assume it is the BBs, who have been described by costata and Bron as ‘spiders in the web of the PM markets’. They see the standing buy/sell orders, and they see the order flow as well.

2. What do these BBs want? They want to book some profits today. So they’ll try to use their position at the center of the web to make money (at your expense).

3. How will they make money? They will be able to tell which way the market is trending thanks to the order flow, and if they see standing orders about to be triggered, they’ll also be able to predict if the market swing will intensify. So:

a. Market is trending in a certain direction.

b. BBs see lots of standing orders about to be triggered.

c. BBs place lots of orders, triggering the standing orders and combining with the market trend to form a large price swing. BBs exit their position at a profit before the swing reverses on them.

d. Easy money.

4. Which direction are these swings more likely to go: up, or down? Are there more standing sell stop orders, or buy stop orders? Are traders/investors/suckers more likely to want to exit positions to preserve a profit / avoid a loss, or to enter positions to jump on a price breakout? Which is more powerful, fear, or greed? I find it likely that the standing sell stops usually significantly outnumber the standing buy stops.

5. Are any of these sell stops “trailing” stops? I.e: sell Y amt of gold if the price drops X dollars from the previous high price. This could matter because, with the gold price trading at new relative highs, the trailing stops could tend to cluster just below the current price.

6. Add the ingredient that victor and I discussed: the gold price tends to be higher in Asian trading, and lower in NY trading. This is likely because of there are more buyers than sellers in Asia, and vice versa in the West. So we have a somewhat predictable daily price tendency: Asia is open so gold price rises, NY opens so gold price declines.

7. Now combine 4, 5, and 6. On a day when COMEX opens after the Asian market bid gold up to new relative highs, you will have:

a. More sell stops than buy stops in the order book, as usual.

b. Trailing stops clustered below the current new high price.

c. Trading flow tending to more sellers than buyers, thus lower prices.

Perfect ingredients for ‘smackdown stew’!

Further, the best time for this ‘smackdown’ is as soon as the price starts to decline on its own accord, which might very well be the minute that the COMEX opens.

Or, maybe traders at different BBs get together and decide that at 8:25 or what have you they will all pile on, so that they get a nice big fat price move and they all get to pad their P&L for the quarter.

*************************************************

Victor just corrected me:

"Sorry I cannot post at Screwtape right now - somehow I cannot get past that stupid captcha. So I am sending this by email:

The posting my Michael H was *not* the one I was referring to.

The one I was referring to was the explanation of the AM-PM effect:

It is the trade flow from Europe/US to Asia. The AM-PM difference is the transportation cost than cannot be arbitraged away. There are more sellers in Europe/US and more buyers in Asia, and there is a constant flow of physical material. So the price in Asia is higher than in Europe/US by up to the shipping cost. Nobody can arbitrage this away as it refers to the physical gold, not to unallocated.

I know that gold and platinum show this effect. Gold always since at least 2001, platinum in all years except 2008. Palladium does not have this effect. If you want to confirm it is shipping costs, you could try to check whether perhaps the exports of platinum to Asia dropped in 2008, and whether there is a net flow of palladium out of Europe - there shouldn't be."

Hi GM Jenkins

I am not employed by Casey - but use ED's blob as a conduit to get my charts out to the public.

I am a one man band on gold/charts/data & been active on the web for a decade or so.

www.sharelynx.com is my eclectic website.

Come by & have a trial.

Here's the chart showing the LBMA BIAS in percentage terms.

http://www.sharelynx.com/chartstemp/LBMApAnnualBias.jpg

I have done close to 100 charts on this LBMA Bias & also now delving out into the others that I can do.

Measureable is the Intraday/Overnight Bias on any dataset with two plots ie AM & PM Fix or Open Close at regular times.

Hence the CME Futures datasets for gold & silver - which I've done.

And I'm starting the same for the LPPM PGM Fixes which show a huge Bias so far.

Bron have been a good friend for many years & he steered me over to this blog.

Victor (via GM) -

I agree that the explanation lies with Asia here, but I don't really get your explanation. Shipping costs don't explain it, because we're talking about London pricing - not Loco-China prices. It makes perfect sense that Loco-China prices are higher - China regulates Gold flow, plus you have to pay for shipping.

but that's not what we're observing, right?

-KD

Yeah, the shipping costs are not an explanation. The AM and PM Fix price is for loco London unallocated or physical metal.

Any Asian dealer selling physical in Asia and hedging themselves by buying on the AM Fix would not bid up the AM Fix to cover any loco difference - that premium is charged to the Asian buyer and mixed up in the fabrication premium etc.

Note also that Asian paper trading can be done loco London, ie your account with us (say Asian broker) is for gold located in London, so no need for any premium.

I would draw people's attention to this article by Martin Armstrong where he talks about silver manipulation from a slightly different perspective.

http://tinyurl.com/7rbnp4b

I actually saw a bumper sticker a while back that said "Crash JP Morgan - Buy Silver." That was before the big crash.... in silver, not JPM.

Frankly, if the silver market is being suppressed, then the logical trade is to go short at the appropriate time. This doesn't preclude owning the physical if that's your game. Just a little paper side bet to take advantage of the manipulation. Seems like the thing to do if you're convinced there actually is manipulation.

Post a Comment