Sunday pre-game 2/19

GoldMoney and its end-of-day price 'manipulation' (updated) (again)

When to buy silver?

Looks to me like Silver is rolling over, and I expect it to drop tomorrow [written Monday evening - Ed.] as will most commodities. I expect a choppy Wednesday. Thursday and Friday are make or break.

Sunday pre-game 2/12/12

I'm happy with the gold action the past two weeks. We've seen a well-needed consolidation to the bottom of the black trend channel on the weekly chart, which, as I mentioned three weeks ago, was to be expected, since we entered it so suddenly, without resistance. Gold hadn't closed a week *on* the black line since July, and if you note, the weekly closes on that line have presaged every strong, sustained rally on the chart (I recall being concerned that the false breakout in October was based off of a poor consolidation).

On the daily chart over the same period, I have drawn in the "$25 Yellow Zone" again, a buffer for all corrections until (what is looking like) the Great Bear Trap of December 2011. Note, we finished right on the upper boundary, after bouncing off the 144-day MA (pink) yet again, which divides the buffer zone in half. I'm bullish from here. Maybe the RSI will fall to the 50 level again, but I'd be a big buyer at that point.

The HUI also looks like it has a lot more upside than downside here. Note that only a 2.5% drop from here will take the HUI to the important intersection of the white line with the $510 horizontal level (which marked the important December 2009 top). I have my dry powder ready if that happens.

Let's return to silver, where, even more than gold, we're going to find out soon enough if the awful action of December 2011 was an anomaly/bear trap. We cleared the purple dotted line a few weeks ago, and it's been effective support since. Let's see if it can hold.

Everybody who follows silver is familiar with the wide downward channel that began with the -35% May 1 Massacre, the top of which we haven't tested since the -40% September Massacre. Though I don't usually look at non-log charts, it appears a lot of people do, and the top of the post-May downtrend channel (purple) is now passing the important $36 level, where it looks like it wants to be hit harder than a cougar who just snorted several lines of coke and poured a bottle of liquid cialis into your vodka martini while you were taking a piss. Granted, around the silver blogosphere there's a lot of talk about JPM shorting silver like crazy, which surely is not a good sign, but I still think the top purple line has to be tested sooner rather than later, because frankly, it seems to me the bottom of the downward channel (red), or even the downward wedge (orange) is no longer in play, on account of so many strong points of support along the way (see grey lines for examples). An obsolete chart formation should be tested on the upside, and resistance should become support. Or so that's what I learned during years of grueling study getting my degree in Chart Science at the University of Phoenix.

On this familiar chart of daily closes, perhaps we'll hit the solid green line first, which I've been waiting for to expand my trading position.

Stuff From the Web (Personal Bookmark)

1. The Turd Speaks - great observations on the current state of things, peeling back the covers of the financial matrix and hitting a home run in the process.

http://www.tfmetalsreport.com/blog/3367/ramblings-lets-talk-dollar-gold-silver-crude-and-freedom

2. The Many Values Of Gold - by Victor the Cleaner - nice summary of the role of gold including some sections on Freegold.

http://victorthecleaner.wordpress.com/2012/02/08/the-many-values-of-gold/

3. "Warren Buffett: Why stocks beat gold and bonds" - my namesake lets everyone know he doesn't like gold and trys to slip as many tulip bubble suggestions into his narrative, with some sage advice on why productive assets trump inactive ones (in normal business environments this is true).

http://finance.fortune.cnn.com/2012/02/09/warren-buffett-berkshire-shareholder-letter/

4. (Via Zero Hedge): visual representation of debt (by 'demonocracy.info'): I simply love visuals like this.

http://demonocracy.info/infographics/usa/world_debt/world_debt.html

I wanted to tie them all in together - the main point is not to forget all that debt represents someone's asset, somewhere out there. That's a lot of assets - so in fact the world is very rich! But it's the quality of said assets that is the question, and whether the productivity of the folk making the regular payments, can keep up (like the Greeks, for example). And, that $160 billion eq. of new gold each year that Buffet complains about, doesn't look so bad when you consider how many $ are out there, swapping between asset classes. I was trying to figure out the comparative value of all the gold stock in the world, against these towers of money ... anywhere between 5-10 trillion, as a really lazy estimate. To be honest, the pile of debt didn't look so bad against all the gold in the world - it's similar to the assets:loan ratio that an average person might have on their house.

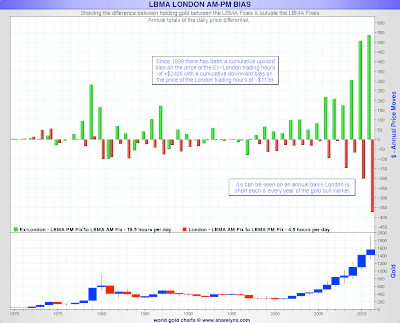

Chart update, and a challenge for manipulation deniers

The red line is the price rise or fall that occurs between the London AM fix and the London PM fix ... Except for a handful of years, it's been showing a negative price bias just about every year for the last 42 years. It's particularly noticeable during the current bull market.So what the overnight markets giveth, the London and New York markets, working together, make every attempt to taketh away. This is where the name of the chart comes from "LBMA London AM-PM Bias."[In] January [data not shown on above chart]… the overnight bias showed an increase of $169...or 10.4%. The London intraday bias was -0.02%. So here we have one of the biggest bull market rallies in January in recorded history, and the cumulative move during the 4.5 hour intra-London trading hours during January was actually negative. This is Anglo/American price fixing scheme laid bare [emphasis mine].

Chart Porn 2/5/2012

*UPDATE: To maintain my unblemished integrity, I feel compelled to disclose that my Super Bowl protest was postponed till next year. Alas, I too gave in to the call of the herd, gorged myself on absurd amounts of unhealthy food, and partook in the exuberance of an event the sheer pagan excess of which presages the imminent disintegration of our civilization.

Special thanks to commenter Dr. Durden for the title suggestion, which I have changed from the usual "Sunday pre-game" in protest of the Super Bowl. If you're unlike me, and you actually care which group of mercenary thugs, oafish simpletons, and peacocking dullards proves better at a childish game than the other, then may I suggest you just check the score when the contest is over? (Rooting for a team has no effect on the outcome, you know… so why subject yourself to the corny commercials rigorously engineered to elicit the maximum number of retard smiles from the proud engine of the global economy, the semi-literate American consumer?). That said, I do recommend you catch at least part of the halftime show. It's a man's duty never to escape from reality, but rather always to look it head on, however ugly it may be. Tonight's decrepit performer, who at her best was a talentless, hysterically vain, self-promoting whore, has finally transmogrified into something meaningful: nothing less than the perfect symbol of her nation (she has surpassed even the globally broadcast military hoopla during the introductions carefully designed to bring fear into the hearts of our numerous enemies, whose pathetic resistance against the noble hegemony of American democracy shall never prevail!)

This will be an important week in the metals. My silver chart (now in color!) reveals two very important crossing points. The $36 level in mid-March and the $33 level in mid-May. But if silver rallies this week, making its way into the purple zone where it was rebuffed Thursday of last week, then it could very possibly go straight to the third important crossing point, the $42-$45 level as early as March. On the other hand, as seems likely, if silver corrects further this week, then this chart is telling me that the red downward channel will continue to exert resistance, such that a strong move in the near future becomes less likely.

Here is the weekly gold chart, where as badly as last week ended, it never fell out of the channel that it had impressively entered the week before. The weekly close this week will be very important. Gold can fall out of the black channel during the week, but a weekly close below would be quite bearish.

Here's the daily chart with the Fibonacci moving averages (144 day, and 377 day, pink and green respectively), as well as the 200 day (yellow) and the 252 day (i.e. yearly) (brown). Note that they are all currently right around their lines of best fit, all of which share the same slope, also shared by the top two black dotted trend lines which go back further than this chart in terms of resistance (note: chart updated, 2/6).

Is gold trading like a safe haven? One way to determine this is to look at the ratio between gold and the CRB commodities index (of course gold is part of that index, but we can ignore that). The CRB goes up with inflation, so if gold goes up faster, then that (at least partly) means people are actually looking for a store of value in fear of future inflation (which other components of the CRB, except for the other precious metals, really are not). You will see that the three red horizontal lines represent three "tiers" over the past decade, such that gold's status as a safe haven is a step function of sorts. The 2008 financial fiasco raised it to a much higher level, and then the "debt ceiling" fiasco of last August took it another small step higher, where it has been trapped, despite 11 attempts to break the top red line (most recently Thursday).

How the PM blogosphere behaves like a cult

I first started seriously browsing the PM blog sites at the end of 2010. I'd traded for years (stocks mostly), but was a relative newcomer to the world of investing in gold and silver. I was struck by the huge amount of apparently helpful online advice, charts, and discussion, all dedicated to gold and silver. I'd never had such a resource to draw from when trading the FTSE, so I became something of an avid reader of these sites. A whole new world was opened up to me: one of Turds and talking bears and Keisers and KWNs and Zero Hedges; not to mention Harvey's Organ [sic] and too many others to name.

I first started seriously browsing the PM blog sites at the end of 2010. I'd traded for years (stocks mostly), but was a relative newcomer to the world of investing in gold and silver. I was struck by the huge amount of apparently helpful online advice, charts, and discussion, all dedicated to gold and silver. I'd never had such a resource to draw from when trading the FTSE, so I became something of an avid reader of these sites. A whole new world was opened up to me: one of Turds and talking bears and Keisers and KWNs and Zero Hedges; not to mention Harvey's Organ [sic] and too many others to name.

Regardless of their motivations, cults are indubitably a dangerous affair, whether they be religious or investment. And it behoves any reader to always be aware of such techniques and organised group think when reflecting on what they read. Always question what you read; always fear confirmation bias; and always beware of any ideology which raises the views of its adherents to 'privileged' and untouchable status.

Have Precious Metals in a Swiss Bank Deposit Box? The IRS Wants to Know

A few weeks ago we had a discussion in the comments of a post here on Screwtape about the issues of storing precious metals abroad. Questions were raised about the potential for metals held in Swiss banks to be subject to future onerous US laws, including confiscation. Mark Nestman recently posted an article that sheds some light on the subject. Entitled "IRS: Offshore Banks will Need to Disclose Precious Metals Held by US Clients", Mr. Nestman wrote on how new regulations under the Foreign Account Tax Compliance Act (FATCA) take aim at US citizens holding precious metals overseas.

A few weeks ago we had a discussion in the comments of a post here on Screwtape about the issues of storing precious metals abroad. Questions were raised about the potential for metals held in Swiss banks to be subject to future onerous US laws, including confiscation. Mark Nestman recently posted an article that sheds some light on the subject. Entitled "IRS: Offshore Banks will Need to Disclose Precious Metals Held by US Clients", Mr. Nestman wrote on how new regulations under the Foreign Account Tax Compliance Act (FATCA) take aim at US citizens holding precious metals overseas. I highly recommend reading the article in its entirety, but below is a key passage:

4. What assets need to be reported? I summarized financial assets that need to be reported on Form 8938here. Henderson confirmed that foreign real estate owned by a U.S. individual isn’t reportable. By extension, precious metals, art, or other personal possessions you maintain in a foreign residence aren’t reportable, either. But, when asked about the reportability of precious metals held by an individual in offshore safe deposit boxes or private vaults. Henderson briefly consulted with one of his colleagues and replied, “That will be covered in forthcoming regulations under Chapter 4.”Henderson was referring to Chapter 4 of FATCA, the subject heading of which is “Taxes to Enforce Reporting on Certain Foreign Accounts.” This is the notorious section that imposes the 30% withholding tax on most U.S. payments to FFIs and NFFEs.To avoid withholding, FATCA requires FFIs (but not NFFEs) to:“…Comply with requests by the Secretary for additional information with respect to any United States account maintained by such institution.”In the context of offshore precious metals holdings, it would be simple for an FFI holding a custodial account on behalf of a U.S. person to provide this information to the IRS. However, Henderson was specifically asked about the reportability of precious metals held in a safety deposit box or private vault.The only way the FFI would be able to obtain the requested information for a safety deposit box would be to obtain an inventory from the owner, or break open the safety deposit box and take its own inventory. If it failed to do so, the FFI would presumably be subject to the 30% withholding regime. I hope this draconian interpretation is incorrect, but the answer will apparently be found in the future regulations for Chapter 4.However, an offshore private vault is arguably not an FFI. FACTA defines a FFI as any non-U.S. entity that:“… (i) accepts deposits in the ordinary course of a banking or similar business, (ii) holds financial assets for the account of others as a substantial portion of its business, or (iii) is engaged (or holding itself out as being engaged) primarily in the business of investing, reinvesting, or trading in securities, partnership interests, or commodities.”An offshore private vault that isn’t engaged or holding itself out to be engaged such activities would seem to be a NFFE, not a FFI. As such, the private vault shouldn’t be subject to FATCA’s withholding regime so long as it can prove that it doesn’t have 10% or greater U.S. ownership. Nor should the vault be required to disclose the names or the investments maintained by U.S. customers.Henderson’s response also implies that offshore precious metals held by an individual in a safety deposit box or private vault aren’t reportable for Form 8938 purposes, at least not for 2011. The case for not reporting the holding on either disclosure form is strongest if you have exclusive access to the box, because in that event you arguably need not report it on either Form 8938 or the FBAR. For the reasons why I don’t think it’s reportable on the FBAR, read this post.

Thus based on the interpretation above, the IRS indeed is indeed looking to force foreign banks to release information on precious metals holdings of its US clients, even if such metals are stored in a safe deposit box. However, private depositories still appear to be exempt (at least for now). Investors with offshore metals holdings would be wise to contact their tax advisors and remain on top of these rapidly changing regulations.